In a concerning development on the dark web, a threat actor known as “b1ack” has made an announcement, claiming the release of a staggering 1 million credit cards on their platform, B1ack’s Stash Market. The announcement, made by b1ack, invites users to claim their share of free credit card information by signing up on the platform and visiting the designated ‘freebies’ section.

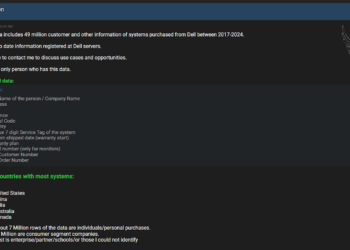

Threat Actor’s Statement:

The threat actor, b1ack, has urged potential users to claim their share of the illicit bounty by signing up on their platform and visiting the “freebies” section. The actor asserts that this giveaway is a token of appreciation to users for choosing B1ack’s Stash for their illicit carding needs. Furthermore, the platform encourages visitors to explore their premium section, boasting an assortment of high-value credit card information, including non-verified by Visa (Non-VBV) cards and dumps.

Potential Motives:

Analysts speculate that such releases often serve as promotional tactics aimed at attracting new members to illegal platforms. By offering free access to sensitive financial data, threat actors like b1ack seek to expand their user base, leveraging these giveaways for advertising purposes.

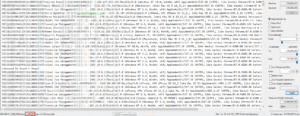

Data Analysis:

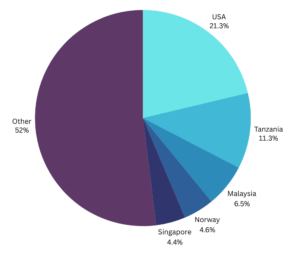

The DailyDarkWeb team analyzed the data set shared by B1ack’s Stash, revealing alarming insights. Out of the total 1,010,001 credit cards detected, a significant portion – 999,068 – are unique. The credit card data spans various countries, with the United States leading the pack at 214,923 cards, followed by Tanzania, Malaysia, Norway, and others.

Top 10 Countries Affected by the Breach:

USA: 214,923 (21.3%)

Tanzania: 114,376 (11.3%)

Malaysia: 65,150 (6.5%)

Norway: 46,160 (4.6%)

Singapore: 44,431 (4.4%)

Thailand: 43,680 (4.3%)

Great Britain: 20,818 (2.1%)

Australia: 14,941 (1.5%)

Philippines: 14,848 (1.5%)

Germany: 11,187 (1.1%)

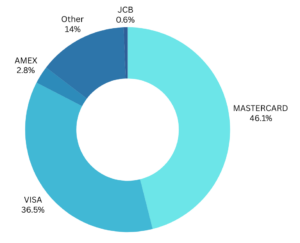

Card Brands and Counts:

MASTERCARD: 465,232 (46.1%)

VISA: 368,996 (36.5%)

AMERICAN EXPRESS: 28,114 (2.8%)

JCB: 6,161 (0.6%)

Card Types:

The dataset includes a mix of debit cards, credit cards and others, with approximately 372,509 debit cards and 440,071 credit cards.

With users encouraged to claim free credit card information and explore premium offerings, the incident underscores the persistent challenges posed by illegal platforms on the dark web. Analysis of the dataset reveals a significant impact across various countries and a mix of debit and credit card types, highlighting the widespread nature of this breach. As cybersecurity efforts continue to evolve, vigilance and proactive measures remain paramount in mitigating the risks of financial fraud and identity theft in the digital age.